The first signs are often small but unsettling. Mortgage statements start arriving at two different addresses. One spouse assumes the other is handling payments. A late notice shows up, followed by a more urgent letter from the lender. Then a certified envelope appears referencing “default” or “intent to accelerate.”

At the same time, legal paperwork related to the divorce is moving through the court system. Emotions are already strained. Financial accounts are being divided. Decisions that once required one conversation now require attorneys, documentation, and formal agreements.

In Fort Walton Beach, I regularly speak with homeowners who are surprised by how quickly a manageable mortgage situation can turn into a foreclosure concern during divorce. It is rarely intentional. More often, it is the result of confusion, communication breakdown, or a simple lack of clarity about who is responsible for what.

Having worked with many individuals in similar circumstances, I have seen how foreclosure during divorce is not just a financial issue. It is layered with stress, uncertainty, and sometimes a sense of urgency that makes it difficult to think clearly. Understanding the foreclosure process and your available options can help you regain a measure of control.

Why Foreclosure Often Follows Divorce

Divorce changes household income overnight. What was once supported by two earners may now depend on one. Even if both spouses were contributing, expenses often increase because two separate households must now be maintained.

In Fort Walton Beach, where property values have fluctuated in recent years, some couples also discover that refinancing is more difficult than expected. One spouse may want to keep the home but cannot qualify for a new loan alone. Meanwhile, the existing mortgage remains in both names.

Common triggers for foreclosure during divorce include:

- Missed payments during legal proceedings

- Disagreements over who should pay the mortgage

- Delays in selling the property

- One spouse moving out and assuming the other will manage the bills

- A temporary income drop during the transition

Lenders are not involved in the divorce agreement. From their perspective, the mortgage contract remains binding regardless of what a family court decides. If payments stop, the foreclosure timeline begins.

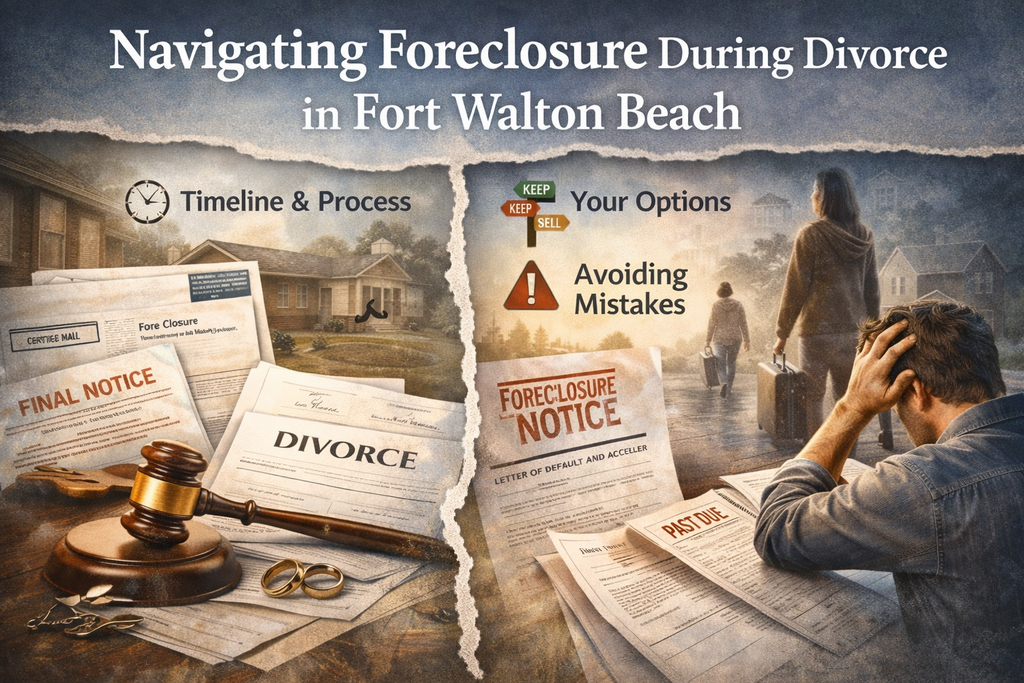

Understanding the Foreclosure Process in Florida

If you are facing potential foreclosure in Fort Walton Beach, it helps to know what typically happens next.

1. Missed Payments and Late Notices

After one missed payment, the lender will assess late fees and send reminders. After multiple missed payments usually around 90 days the loan is considered in default.

2. Notice of Default and Acceleration

You may receive a formal letter stating that the full balance of the loan could become due if the default is not cured. This is often referred to as acceleration. It can be intimidating, especially during divorce proceedings.

3. Filing of Foreclosure Lawsuit

Florida is a judicial foreclosure state. That means the lender must file a lawsuit in court. You will be formally served with foreclosure papers and given a set period to respond.

4. Court Proceedings

If the matter is not resolved, the case proceeds through the court system. A judge may ultimately issue a foreclosure judgment, and the property will be scheduled for auction.

The timeline can vary, but the process often takes several months sometimes longer depending on court schedules and whether the case is contested.

The Emotional Weight of Two Legal Processes

Divorce and foreclosure are each significant life events. When they occur simultaneously, the emotional strain multiplies.

There is often fear about credit damage, concerns about long-term financial security, and anxiety about future housing. In Fort Walton Beach, where many families have strong ties to schools, employment, and community, the thought of losing a home during an already difficult transition can feel overwhelming.

It is important to remember that foreclosure is a process, not an immediate event. You typically have time to explore options before a final outcome is determined.

Your Options During Foreclosure and Divorce

There is no single solution that works for every household. The right path depends on equity, income, cooperation between spouses, and long-term goals.

1. Keeping the Home

If one spouse wishes to remain in the home, refinancing into a single name is often the cleanest solution. This removes the other spouse from liability and stabilizes the loan.

However, qualification depends on credit score, debt-to-income ratio, and income documentation. If refinancing is not possible, loan modification with the lender may be explored.

2. Payment Arrangements or Loan Modification

Lenders sometimes offer repayment plans or loan modifications that adjust the terms of the mortgage. This could involve extending the loan term or adjusting interest rates.

These options require documentation and lender approval, and they can take time. During divorce, coordination between both borrowers may be necessary.

3. Selling the Home Traditionally

Listing the property with a real estate agent is a common approach. If there is equity in the home, selling on the open market can allow both parties to pay off the mortgage and divide remaining proceeds.

This route typically involves preparing the property for showings, negotiating offers, and waiting through the closing process. In Fort Walton Beach, market conditions and seasonal demand can affect timing.

4. Short Sale

If the home is worth less than the remaining mortgage balance, a short sale may be considered. This involves lender approval to accept less than what is owed.

Short sales can help avoid foreclosure, but they require lender cooperation and can extend the timeline.

5. Selling Directly to a Local Buyer

Some homeowners prioritize speed or certainty, particularly when divorce proceedings require a clear financial resolution. A direct sale to a local buyer may provide a defined timeline and reduce preparation requirements.

This option does not involve public showings or traditional listing periods. It can be particularly appealing if repairs are needed or if coordination between spouses is difficult.

Each of these paths carries different financial and legal implications. None is universally better only more suitable depending on circumstances.

Common Mistakes to Avoid

When divorce and foreclosure intersect, several predictable mistakes tend to occur.

Assuming the Other Person Is Handling It

Many homeowners discover too late that no one was making payments.

Ignoring Lender Communication

Certified letters and court documents can be intimidating, but ignoring them limits your options.

Waiting for the Divorce to Finalize

Foreclosure does not pause while legal negotiations continue. Addressing the mortgage proactively is critical.

Letting Emotion Delay Decisions

It is understandable to feel attached to the home. However, financial decisions should be grounded in practicality rather than sentiment alone.

Practical Steps You Can Take This Week

If you are facing foreclosure during divorce in Fort Walton Beach, consider these actions:

- Contact your lender to confirm the current status of the loan.

- Request a payoff statement to understand exact figures.

- Review your divorce agreement to clarify mortgage responsibility.

- Speak with a local real estate professional to evaluate property value.

- Consult with a foreclosure or real estate attorney if you have been served.

Clarity reduces anxiety. When you understand numbers and timelines, decisions become more manageable.

When Certainty or Speed Becomes the Priority

In some divorce situations, both parties simply want closure. They may not want to continue co-owning property or coordinating showings. They may also wish to avoid extended court involvement related to foreclosure.

In Fort Walton Beach, some homeowners explore direct sale options for that reason. Panhandle Real Estate Investments is one local group that works with individuals facing foreclosure and complex property transitions.

Reviewing resources like this can help you compare traditional listing timelines with alternative approaches. For some, the appeal lies in a defined closing date and simplified process during an already demanding life event.

Again, it is one option among several not a one-size-fits-all solution.

Moving Forward With Clarity

Foreclosure during divorce can feel like two legal systems moving at once. It is easy to feel pulled in different directions.

But when you break the situation into parts understanding the foreclosure timeline, reviewing financial options, and identifying realistic paths forward the picture becomes clearer.

In Fort Walton Beach, homeowners navigate these challenges every year. With accurate information and thoughtful planning, it is possible to protect your financial stability and move into the next chapter with greater confidence.

The key is addressing the issue directly rather than avoiding it. When you understand your options, you can make decisions based on stability rather than urgency.